The won closed at 1,280.5 per dollar, Thursday, depreciating by 2 won from the previous day's close.

Thursday's exchange rate still marked a big improvement considering it stayed in the 1,300 won level for the past couple of months as the Fed was sustaining its hawkish monetary policy in a bid to better curb inflation.

"Under the circumstances, I'd say the won will continue to strengthen against the dollar and the won-dollar exchange rate may settle at the lower or mid-1,200 won level by the end of this year," NH Futures analyst Kim Seung-hyuk said.

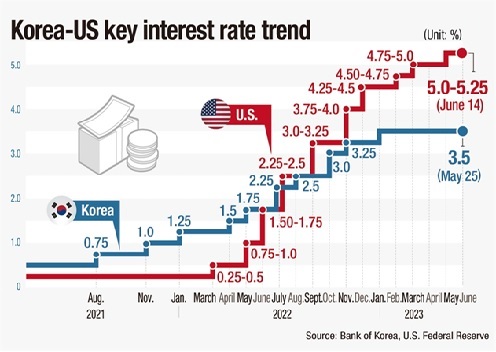

With regard to Fed Chair Jerome Powell's remark that the rate hikes are not over, Lee Sang-ho, head of the economic policy team at the Korea Economic Research Institute (KERI), expects the Fed will continue to keep its policy rate steady "for the time being."

Powell said U.S. inflation, although it dropped to a two-year low of 4 percent in May, is still higher than the target goal of 2 percent. He said, "We're stretching out to a more moderate pace of hiking."

"But even if the Fed is open to the possibility of an additional rate increase, the recent collapse of Silicon Valley Bank (SVB) and other rate-related problems suggest hike decisions will not be made easily," Lee said.

"Corresponding to the anticipation, the currency rate in Seoul will be further stabilized and the won is believed to settle at the level of 1,200 per dollar."

Market observers also downplayed persistent concerns over the outflow of foreign capital in search of safe-haven assets due to a streak of U.S rate hikes and a record-high 1.75 percent interest rate gap between Korea and the U.S.

The Korean policy rate stands at 3.5 percent, as compared to the U.S. rate at a range of 5 to 5.25 percent.

Nevertheless, Bank of Korea (BOK) data showed stocks and bonds purchased by foreign investors amounted to $11.43 billion in May. It marked the biggest amount the BOK has recorded in the 23 years it has been compiling relevant data.

"The buying spree of foreigners certainly helps strengthen the value of the Korean currency, against the belief that they will leave the financial market here amid a widening Korea-U.S. interest gap," Hana Bank researcher Seo Jung-hoon said.

The latest moves by conglomerates to bring back earnings from abroad following enhanced tax incentives were seen by experts as possible momentum for the won to settle at the level of 1,200 per dollar.

Asked about downside risks concerning the won-dollar exchange rate, Meritz Securities analyst Park Soo-yeon said China's slower-than-expected economic recovery could affect Korea's economy, stock market as well as currency market.

Park noted that the benchmark KOSPI retreated 10.54 points to close at 2,608.54, Thursday, as multiple economic indexes on China underperformed and offset the effect of the Fed's rate freeze.

Meanwhile, the BOK said it will "pay attention" to the possibility of additional rate hikes by the Fed.

Source: The Korea Times (16-6-2023)

By Yi Whan-woo

(Economic Counsellor, Nanning)